DIVA Protocol Mainnet Launch

By Walodja1987 at

We are excited to announce the highly anticipated mainnet launch of DIVA Protocol. This marks a significant milestone in our mission to disrupt the $500+ trillion derivatives industry by providing a secure and open smart contract-based infrastructure to create and manage derivative financial contracts peer-to-peer. With DIVA Protocol on mainnet, users can now create and manage custom derivative financial contracts with digital assets of actual value at stake.

This article covers everything you need to know about the launch and the journey that lies ahead.

🚀 Mainnet chains

On 4/5th June, DIVA Protocol was successfully deployed on multiple mainnet chains, including Ethereum, Polygon, Arbitrum One, and Gnosis, all at the same address: 0x2C9c47E7d254e493f02acfB410864b9a86c28e1D. As part of our commitment to transparency, we have open-sourced the code, allowing anyone to verify the functionality of the DIVA Protocol smart contract.

Additionally, we deployed the first oracle adapter using the Tellor Protocol on the same networks at address 0x7950DB13cc37774614B0AA406e42a4C4f0BF26a6. This provides users with a highly flexible and decentralized oracle solution for outcome reporting right from the start. For detailed instructions on how to use it, please refer to the official documentation.

We acknowledge that the official announcement of these achievements experienced a slight delay primarily due to the migration of existing backend infrastructure and frontend applications to the final smart contracts. We would like to express our gratitude to our community for their patience and support during this process. 🙏

🔒 Smart contract audit

The security of the DIVA Protocol smart contract is our top priority. In order to ensure the safety of the protocol and user funds, we have engaged six independent teams to review the codebase. We are proud to report that none of the audit teams found any critical vulnerabilities. The few High and Medium findings have been remediated. A summary of the findings as well as the actual audit reports are available in the DIVA Protocol GitHub repository.

A special acknowledgement goes to Owen and his teams at Solidity Labs who performed the audit as part of a practice audit and discovered unique findings that none of the paid audit firms were able to uncover.

🪙 DIVA Token

The DIVA Token (0x4B7fFCB2b92fB4890f22f62a52Fb7A180eaB818e) was deployed alongside the mainnet launch on the Ethereum network due to its crucial role in the DIVA ecosystem. DIVA Token holders have the power to influence the direction of the protocol by delegating the management of the treasury funds and (limited) protocol governance rights to candidates of their choosing.

Initially, DIVA Technologies AG, a Swiss-based entity led by Wladimir Weinbender, one of the Co-Founders of DIVA Protocol, will serve as the first delegate. The delegate’s role is to support DIVA Token holders in executing the adoption strategy in an efficient and effective manner.

It is important to highlight that DIVA Token holders retain the power to vote in favor of another candidate at any point in time in a fully decentralized manner. For a detailed understanding of the voting mechanism, we invite you to explore our previous blog post.

DIVA Token distribution

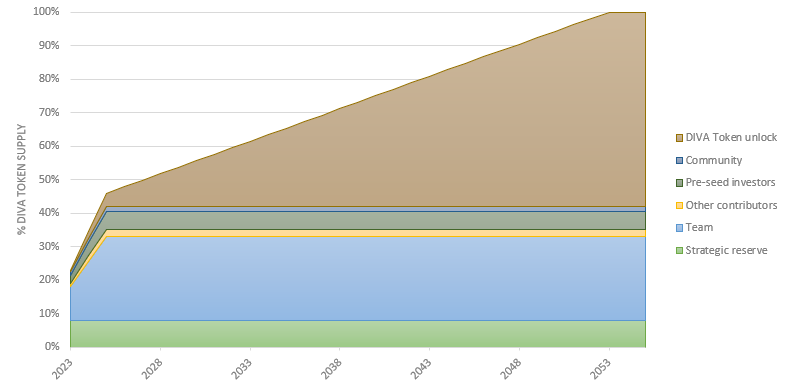

A total of 34 million DIVA Tokens, out of the maximum supply of 100 million, have been allocated among four main groups, spanning across 17’482 accounts:

- Team (25 million): 17 individuals who have directly contributed to the development of DIVA Protocol, including the smart contract, backend infrastructure, and frontend applications.

- Other contributors (2.2 million): Individuals who have made valuable contributions to integrations, use cases, and provided advice or participated in various activities organized by the DIVA Protocol team. It includes members of Tellor Protocol, Fortune Credit, Shamba Network, GoPlugin, Solidity Labs, DIVA Donate campaign donors, 888Whales holders, audit sponsors, and select core contributors to the Ethereum ecosystem.

- Pre-seed investors (5.4 million): Our early financial supporters who have played a crucial role in the foundational stages of DIVA Protocol. These include Darley Technologies AG, DWF Labs, and family & friends.

- Community (1.4 million): Users who participated in the incentivized testnet held in 2022 and the regular quiz sessions.

Note that recipients of more than 15’000 DIVA Tokens, including the team and pre-seed investors, are subject to a two-year vesting period, during which 60% of their allocation will be vested.

Additionally, 58 million tokens have been deposited into the DIVA Development Fund. These tokens will be programmatically unlocked at a rate of 1.93 million tokens p.a. over a period of 30 years to support the on-going development of the ecosystem. Refer to the DIVA Development Fund section to learn more about the purpose and intended use of the funds.

The remaining 8.0 million DIVA Tokens have been temporarily reserved for on-going sale discussions with potential investors and are accessible by the initial protocol delegate, DIVA Technologies AG. If fundraising efforts do not materialize as expected, any unused tokens will be re-deposited into the DIVA Development Fund subject to the same 30-year release period.

Overall, the initial circulating supply amounts to 22.7 million tokens and will increase to approximately 45.6 million tokens by the end of year 2, after vesting and realized token unlocks. It's important to highlight that the circulating supply will decrease if unused strategic reserves are locked back into the DIVA Development Fund.

The chart below illustrates the token distribution over time:

How to claim your DIVA Token reward?

Head over to the Rewards tab on our website, connect your wallet to the Ethereum network and claim your reward.

The data required to prove to the token distributor contract that you are eligible to claim was backed up on IPFS, which allows anyone to claim their tokens even if the website is no longer available.

Please note that you have three years to claim your reward. Any unclaimed rewards will be claimable by the owner of the token distribution contract afterwards.

What can you do with your DIVA Token after claiming it?

Once you have claimed your DIVA Token from the DIVA Protocol website, you have several options available:

- Vote (intended use): Stake your tokens towards the first delegate, DIVA Technologies AG (0xb12daD08CC6aBd5c7Ad0ac136180c6DFaD48431a), or select another candidate of your choice. In the next section, we provide a step-by-step description of how to stake your tokens.

- Trade: Since the DIVA Token complies with the ERC20 standard, you have the option to trade it on any decentralized exchange (DEX). We will make sure to update the community if token holders create a market on Uniswap or other platforms. Note that our team is committed to prioritizing secure decentralized solutions, and therefore, will not actively pursue a listing on a centralized exchange.

- HODL: Don’t feel comfortable doing any of the above? Then simply HODL.

How to vote with your DIVA Token?

To vote with your DIVA Tokens for a candidate of your choice, follow these steps:

- Navigate to the DIVA Token contract on Etherscan and use the approve function to allow the Ownership contract to transfer your DIVA Tokens. Set the spender as 0xE39dEC81B2186A1A2e36bFC260F3Df444b36948A, and the amount equal to the number of tokens you want to stake appended with 18 zeros (e.g., enter 125000000000000000000 for 125 tokens).

- Proceed to the Ownership contract on Etherscan and execute the stake function using the candidate address and the number of tokens you wish to stake, also appended with 18 zeros. Note that the amount must be equal or smaller than the one approved in the previous step.

If you want to help us develop a more user-friendly governance dashboard (Figma designs already exist), please reach out in our Discord.

🏦 DIVA Development Fund

The DIVA Development Fund was established to provide an opportunity for everyone to support the ongoing development of the DIVA ecosystem. Individuals can contribute to the fund by depositing ETH or any other ERC20 token (excluding rebasable and fee tokens) into the fund. This can be done either by directly sending assets to the Ethereum contract (0xb3e25F6c7d1074f2cfE0F2Dc8586D1e74234338b), allowing for immediate claimability by the owner (initially DIVA Technologies AG), or by using the deposit function, which enables specifying a release period.

As part of our commitment to fostering community growth and development, the DIVA Protocol founding team has deposited 58 million tokens (58%) of unreleased DIVA Tokens into the DIVA Development fund. The intention is to distribute them strategically in a retroactive manner to future contributors. This initiative draws inspiration from Optimism's Retroactive Public Good Funding program. More comprehensive information about the Retroactive DIVA Ecosystem Funding program will be shared in a separate article.

Another 8 million tokens are currently held as a strategic reserve and immediately claimable, but will be re-deposited into the Development Fund subject to the same 30-year release period if fundraising efforts do not materialize as expected. This will bring the total amount reserved for development to 66 million DIVA Tokens.

👷Open-sourcing the code

We are dedicated to transparency and fostering collaboration within the developer community. As such, we have open-sourced all the code we have written since the inception of the DIVA Protocol project. This includes:

- DIVA Protocol: This repository contains the smart contract code for DIVA Protocol, enabling anyone to verify its functionality.

- DIVA App: An OTC marketplace for creating, trading and settling derivative products (https://app.diva.finance/).

- DIVA subgraph: Subgraph designed to store and provide easy access to DIVA Protocol-related blockchain activity.

- DIVA Tellor subgraph: Subgraph designed to store and provide easy access to Tellor Protocol-related blockchain activity.

- Tellor oracle client: A client that monitors and reports the outcomes for expired DIVA pools using the Tellor oracle adapter.

- DIVA Website: The DIVA Protocol website (https://www.divaprotocol.io/).

- DIVA-0x-API: An API service that hosts 0x and DIVA Protocol related EIP712 orders and offers.

- DIVA Donate: A conditional donation platform (www.divadonate.xyz).

- DIVA ViZ: An app to visualize derivative product offers and share on Twitter (https://divaviz.com/).

- Oracles: A repository that includes oracle integrations for DIVA Protocol. The Tellor integration has been audited and is available for use. Additional integrations are currently in development, most notably GoPlugin (Chainlink fork) on the XDC network.

If you are passionate about contributing to any of these projects, we invite you to join our 👷Builders channel on Discord. Your contributions will help shape the future of DIVA Protocol and drive innovation within the decentralized finance landscape. The best part is that contributions will be rewarded via the Retroactive DIVA Ecosystem Funding (RetroDEF) program.

If you are seeking more project ideas, we encourage you to check out the Project Ideas section in our GitBook. It includes ideas for apps, oracle integrations, market-making bots, smart contracts, and educational content.

🚆 What’s next?

Our vision is to establish DIVA Protocol as the leading infrastructure for creating custom derivative financial contracts peer-to-peer. With the successful mainnet launch of DIVA Protocol, our focus will now shift towards building exciting use cases and finding product-market fit leveraging the existing infrastructure. This mainly includes:

- DIVA Donate: Expanding the existing DIVA Donate platform to onboard more campaigns and users, facilitating conditional donations.

- Predictions/Bets: Assisting individuals within the Crypto Twitter community in setting up their prediction/betting markets using DIVA Protocol.

- Partnerships: Seeking collaborations with other DeFi projects, oracle communities, and traditional financial institutions to launch joint products and proof-of-concepts.

- Education: Providing educational resources and fostering a community-driven knowledge sharing environment to enable users and developers to fully understand and utilize DIVA Protocol's capabilities.

🌔 Conclusion

DIVA Protocol’s mainnet launch kicks off a new paradigm in the creation and management of derivative financial contracts. It marks the beginning of an exciting journey filled with innovation and groundbreaking possibilities.

We invite you to join our community, explore the opportunities DIVA Protocol has to offer, and be a part of the revolution in decentralized finance. Together, we will build a stronger, more inclusive financial ecosystem that empowers individuals and communities. Let's shape the future of finance with DIVA Protocol! 💪

🔗 Links

- 🌐 Website: divaprotocol.io/

- 🍏 Github: github.com/divaprotocol/diva-protocol-v1

- 📚 Docs: docs.divaprotocol.io/

- 🦜 Twitter: twitter.com/divaprotocol_io

- 🤖 Discord: discord.gg/8fAvUspmv3