DIVA Tokenomics

By Walodja1987 at

As we approach the launch of our mainnet in early 2023, we are excited to unveil the final details of the DIVA tokenomics. We believe that the DIVA token design offers a novel solution for token-based governance that addresses the common problems that plague other tokens. This includes slow processes and execution, low participation in governance as well as a lack of flexibility in the tokenomics to accommodate the changing needs of the protocol over time.

Most of those weaknesses result from enforcing decentralization too early, before product market fit is found. Decentralization is a process that takes time. Our goal is to strike a balance between maintaining flexibility and control in the early stages of the protocol while still working towards full decentralization.

We have designed an innovative decentralized delegation mechanism that allows for fast execution without sacrificing decentralization, giving DIVA token holders the ability to efficiently and effectively participate in governance.

Decentralized delegation

The DIVA token’s main functionality is delegation via staking. DIVA token holders delegate the decision-making to a central party, also referred to as the protocol owner, by staking DIVA tokens towards their account. The protocol owner is responsible for driving adoption and value creation initiatives on behalf of DIVA token holders, including growing the developer community, increasing the number of applications built on top of the protocol, and expanding oracle integrations.

Most importantly, the protocol owner is expected to work towards the ultimate goal of transferring protocol ownership to DIVA token holders as the protocol matures. In return, the protocol owner is given exclusive access to protocol fees and DIVA token issuance to fund those initiatives.

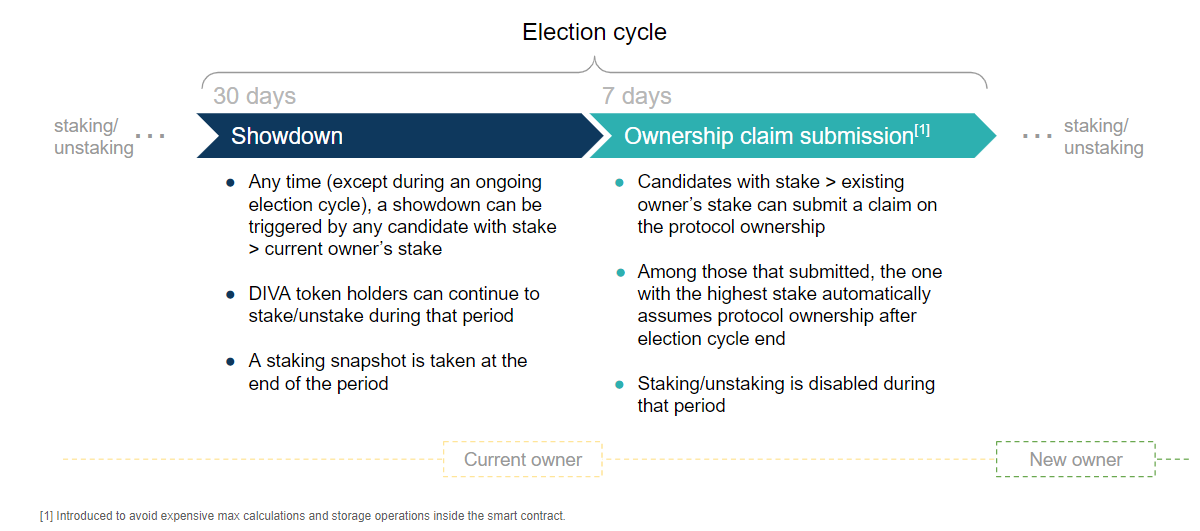

Despite the centralized element, the power remains in the hands of the DIVA token holders. At any point in time, DIVA token holders can vote to replace the current protocol owner by directing their stake towards a new candidate. If a candidate receives more support than the current owner (as measured by staked amount), a 30-day showdown period can be triggered by the corresponding candidate. At the end of this period, a snapshot of the candidates’ stakes is taken, and the candidate with the most support can assume protocol ownership and with that gain access to future protocol fees and DIVA token issuance. This process is referred to as a decentralized protocol takeover (DPT) mechanism and its technical implementation on a smart contract level depicted below:

Initially, the Genesis team will hand over protocol ownership to DIVA Technologies AG, a company founded by one of the co-founders and incorporated in Switzerland.

Benefits

The decentralized delegation mechanism has a number of benefits that make it an attractive solution for token-based governance. These benefits include:

- Fast execution: Delegation provides flexibility and fast execution, which is especially important in the early stages of a protocol’s lifetime.

- Minimal governance: With the DIVA token, holders can simply stake for their favorite candidate and then let the protocol owner do the work, without needing to constantly monitor and participate in governance processes. Token based polls can still be conducted by the protocol owner to get the community‘s input on specific topics.

- Decentralized: The decentralized protocol takeover mechanism allows for a centralized element, while still keeping any delegate in check and ensuring decentralization.

- Flexible tokenomics: The token utility can be extended by the protocol owner over time, allowing for a level of flexibility that can accommodate the changing needs of the protocol. Eventually, the protocol owner can be set to a smart contract address that operates based on a set of predefined and predictable rules.

Protocol fee

To ensure the long-term success and sustainability of the DIVA Protocol project, a small protocol fee of 0.25% will be charged at redemption. The fee can be updated by the protocol owner within a hard-coded range of 0-2.5%.

Token supply

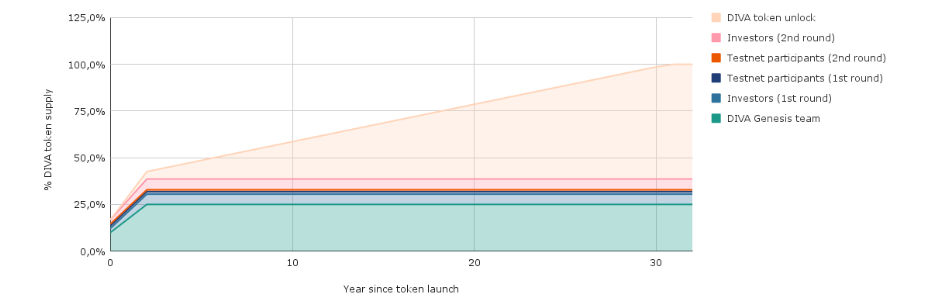

With a maximum of 100 million DIVA tokens in existence, c. 20% will be unlocked at mainnet launch in Q1 2023 and another 15-20% in the following two years due to vesting. The remaining tokens will be gradually unlocked at a rate of 2% per year, subject to the supply cap, to fund the continued development of the protocol. This source of funding will be particularly important in the early phase of the protocol where protocol fees may be insufficient.

The token unlock schedule is illustrated below. Note that the figures are still indicative due to on-going fundraising and upcoming second testnet phase. Final numbers will be confirmed and published closer towards mainnet launch.

Conclusion

To summarize, the DIVA token design introduces a novel token-based governance mechanism that allows for a centralized element without giving up the power of DIVA token holders. This allows fast execution in the early phase of the protocol, efficient and effective governance participation and a clear path towards full decentralization as the protocol matures.

To give everyone a chance to take part in the DIVA protocol governance and help shape the future of the project, we are planning to conduct a DIVA token sale shortly after mainnet launch. Stay tuned for further updates on this.

Links

- 🌐 Website: https://www.divaprotocol.io/

- 📚 Docs: https://docs.divaprotocol.io/

- 🍏 DIVA Testnet App: https://app.diva.finance/

- 🦜 Twitter: https://twitter.com/divaprotocol_io

- 🤖 Discord: https://discord.gg/8fAvUspmv3